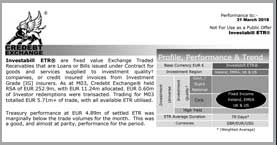

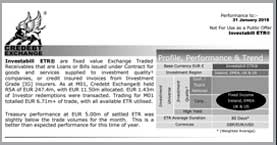

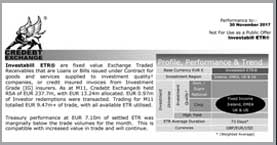

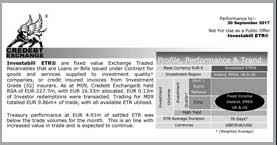

Investabill ETR® are fixed value Exchange Traded Receivables that are loans or bills issued under contract for goods and services supplied to investment quality† companies, or credit insured invoices from Investment Grade [IG] insurers. As at M03, Credebt Exchange® held RSA of EUR 252.9m, with EUR 11.24m allocated. EUR 0.60m of Investor redemptions were transacted. Trading for M03 totalled EUR 5.71m+ of trade, with all available ETR utilised.

Treasury performance at EUR 4.89m of settled ETR was marginally below the trade volumes for the month. This was a good, and almost at parity, performance for the period.