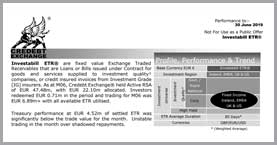

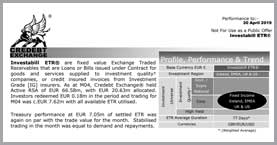

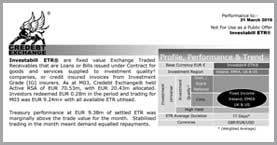

Investabill ETR® are fixed value Exchange Traded Receivables that are Loans or bills issued under contract for goods and services supplied to investment quality† companies, or credit insured invoices from Investment Grade [IG] insurers. As at M10, Credebt Exchange® held Active RSA of EUR 21.78m, with EUR 22.68m allocated. Investors redeemed EUR 1.48m in the period and trading for M10 was EUR 7.99m+ with all available ETR utilised.

Treasury performance at EUR 7.54m of settled ETR was almost at parity with trade value for the month. Collections have increased in line with expectations.