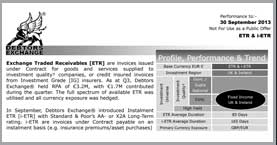

Exchange Traded Receivables [ETR] are invoices issued under Contract for goods and services supplied to investment quality† companies, or credit insured invoices from Investment Grade [IG] insurers. As at Q3, Credebt Exchange® held RPA of €3.2m, with €1.7m contributed during the quarter. The full spectrum of available ETR was utilised and all currency exposure was hedged

In September, Credebt Exchange® introduced Instalment ETR [i-ETR] with Standard & Poor’s AA- or X2A Long-Term rating. i-ETR are invoices under Contract payable on an instalment basis (e.g. insurance premiums/asset purchases)