2023-M08 v 2022-M08 was down 39.03% with EUR 15.35m in M08 2023 v EUR 25.18m in M08 2022. Our volumes remained down this month by 18.53% as the value to volume ratio increases in line with higher value (and quality) traded ETR. Value remains ahead…

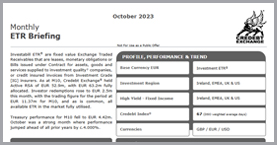

Investabill ETR® are fixed value Exchange Receivables that are leases, monetary obligations or Bills issued under Contract for assets, goods and services supplied to investment quality† companies, or credit insured invoices from Investment Grade [IG] insurers. As at M10, Credebt Exchange® held Active RSA of EUR 52.9m, with EUR 63.2m fully allocated. Investor redemptions rose to EUR 2.5m this month, with the trading figure for the period at EUR 11.37m for M10, and as is common, all available ETR in the market fully utilised.

Treasury performance for M10 fell to EUR 4.42m. October was a strong month where performance jumped ahead of all prior years by c.4.000%.