2017-M07 v 2016-M07 trade value in the period showed a 4.63% increase. This is below the average annual growth rate of 70.00%+. 2017-M06 trade volumes were down by -24.25% on 2016-M07 volumes. Total creditors & debtors increased to c.3,500 in the month with total trade…

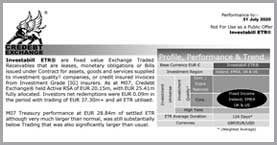

Investabill ETR® are fixed value Exchange Traded Receivables Receivables that are leases, monetary obligations or bills issued under contract for assets, goods and services supplied to investment quality† companies, or credit insured invoices from Investment Grade [IG] insurers. As at M07, Credebt Exchange® held Active RSA of EUR 20.15m, with EUR 25.41m fully allocated. Investors net redemptions were EUR 0.09m in the period with trading of EUR 37.30m+ and all ETR utilised.

M07 Treasury performance at EUR 28.84m of settled ETR although very much larger than normal, was still substantially below Trading that was also significantly larger than usual.