2020-M11 v 2019-M11 trade value was 83.28% higher. Continued international trade finance deals support this business sector as it develops in 2020-Q4. Trade volumes were 13.33% lower than prior year results. Investors withdrawals of c.EUR 0.36m were again seasonally low...

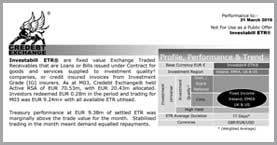

Investabill ETR® are fixed value Exchange Traded Receivables that are loans or bills issued under contract for goods and services supplied to investment quality† companies, or credit insured invoices from Investment Grade [IG] insurers. As at M11, Credebt Exchange® held Active RSA of EUR 89.30m, with EUR 21.45m allocated. Investors redeemed EUR 0.25m in the period and trading for M11 was EUR 9.17m+ with all available ETR were utilised.

Treasury performance at EUR 8.41m of settled ETR was in line with the trade value for the month. Stabilised trading during the month roughly equalled demand and repayments.