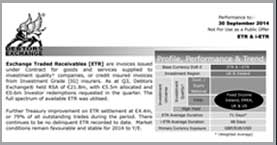

2014-Q1 was the third quarter of trading for Credebt Exchange®. Total Debtors numbered 280+ with a total trade value of € 8.1m to date. Daily volume declined for the period at 25+ due to i-ETR suspension. Highest single value trade was in January at €…

Exchange Traded Receivables [ETR], are invoices issued under Contract for goods and services supplied to investment quality† companies, or credit insured invoices from Investment Grade [IG] insurers. As at Q3, Credebt Exchange® held RSA of €21.8m, with €5.5m allocated and €0.6m Investor redemptions requested in the quarter. The full spectrum of available ETR was utilised.

Further Treasury improvement on ETR settlement at €4.4m, or 79% of all outstanding trades during the period. There continues to be no delinquent ETR recorded to date. Market conditions remain favourable and stable for 2014 to Y/E.