2014-Q1 was the third quarter of trading for Credebt Exchange®. Total Debtors numbered 280+ with a total trade value of € 8.1m to date. Daily volume declined for the period at 25+ due to i-ETR suspension. Highest single value trade was in January at €…

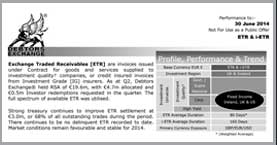

Exchange Traded Receivables [ETR], are invoices issued under contract for goods and services supplied to investment quality† companies, or credit insured invoices from Investment Grade [IG] insurers. As at Q2, Credebt Exchange® held RSA of €19.6m, with €4.7m allocated and €0.5m Investor redemptions requested in the quarter. The full spectrum of available ETR was utilised.

Strong treasury continues to improve ETR settlement at €3.0m, or 68% of all outstanding trades during the period. There continues to be no delinquent ETR recorded to date. Market conditions remain favourable and stable for 2014.