2019-M10 v 2018-M10 showed an easing in trade volume decrease to -13.48% with trade value decrease easing to -26.22%. SME access to trade credit continues to be a negative factor. The Credebt® Index of 94 indicates a favourable market for the Exchange for Q4 and…

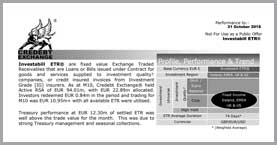

Investabill ETR® are fixed value Exchange Traded Receivables that are loans or bills issued under contract for goods and services supplied to investment quality† companies, or credit insured invoices from Investment Grade [IG] insurers. As at M10, Credebt Exchange® held Active RSA of EUR 94.01m, with EUR 22.89m allocated. Investors redeemed EUR 0.84m in the period and trading for M10 was EUR 10.95m+ with all available ETR were utilised.

Treasury performance at EUR 12.30m of settled ETR was well above the trade value for the month. This was due to strong Treasury management and seasonal collections.